Hassle-free Medicare Supplements: Medicare Supplement Plans Near Me

Hassle-free Medicare Supplements: Medicare Supplement Plans Near Me

Blog Article

Recognizing the Perks of Medicare Supplement in Insurance Coverage

Navigating the facility landscape of insurance choices can be a complicated job, especially for those coming close to retirement age or currently signed up in Medicare. However, among the selection of options, Medicare Supplement intends stick out as an important source that can offer satisfaction and monetary security. By understanding the benefits that these strategies provide, people can make informed choices concerning their health care insurance coverage and ensure that their demands are effectively met.

Relevance of Medicare Supplement Plans

When thinking about health care protection for retired life, the importance of Medicare Supplement Plans can not be overstated. Medicare Supplement Plans, also understood as Medigap policies, are created to fill up in the gaps left by conventional Medicare protection.

Among the crucial benefits of Medicare Supplement Program is the satisfaction they use by giving added financial security. By paying a regular monthly premium, individuals can better allocate healthcare costs and avoid unexpected clinical costs. Moreover, these plans typically supply protection for health care services received outside the USA, which is not supplied by initial Medicare.

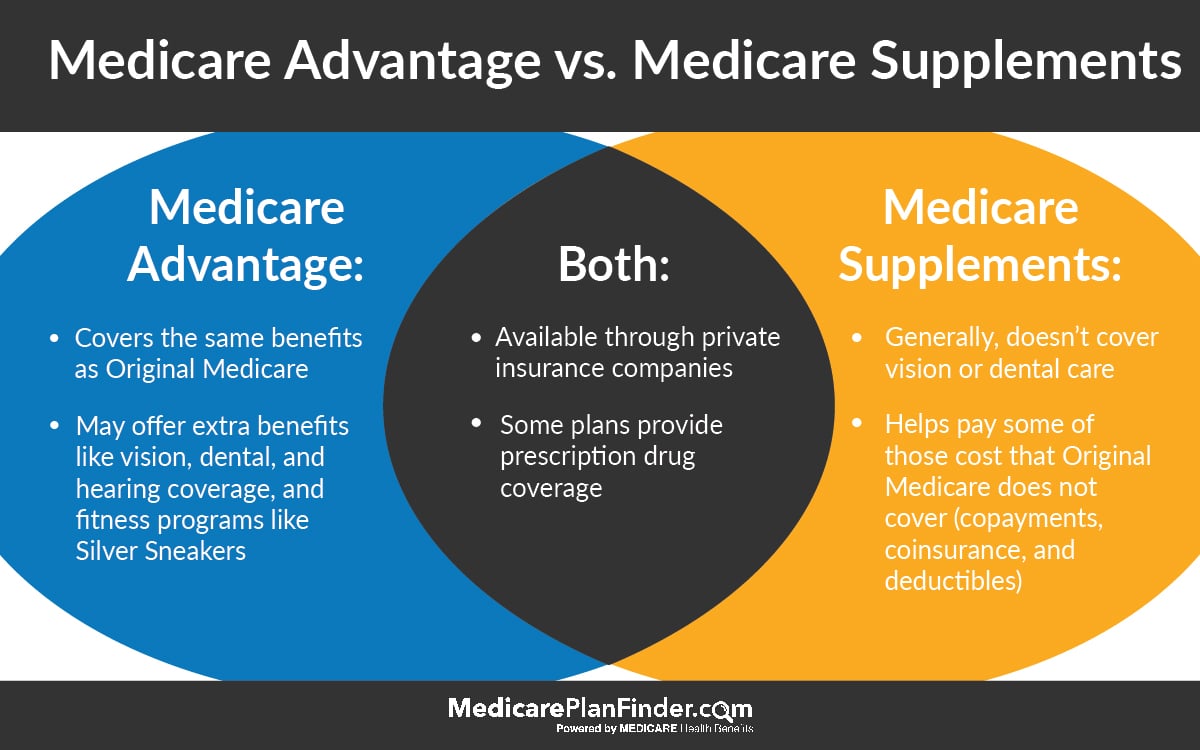

Protection Gaps Dealt With by Medigap

Resolving the voids in protection left by conventional Medicare, Medicare Supplement Plans, additionally referred to as Medigap policies, play an essential duty in supplying detailed healthcare coverage for individuals in retirement. While Medicare Part A and Component B cover lots of health care expenditures, they do not cover all expenses, leaving recipients susceptible to out-of-pocket costs. Medigap strategies are created to fill up these protection spaces by spending for specific medical care expenses that Medicare does not cover, such as copayments, coinsurance, and deductibles.

One of the considerable advantages of Medigap plans is their ability to supply financial security and satisfaction to Medicare beneficiaries. By supplementing Medicare protection, individuals can better handle their healthcare expenditures and avoid unforeseen financial problems associated with medical care. Medigap policies supply flexibility in selecting medical care service providers, as they are usually accepted by any type of health care company that approves Medicare job. This adaptability permits recipients to receive care from a vast array of physicians and experts without network constraints. Generally, Medigap strategies play a vital role in making sure that senior citizens have accessibility to thorough health care insurance coverage and economic protection throughout their later years.

Cost Financial Savings With Medigap Plans

With Medigap plans properly covering the voids in traditional Medicare, one notable advantage is the capacity for substantial expense financial savings for Medicare recipients. These plans can help in reducing out-of-pocket expenditures such as copayments, coinsurance, and deductibles that are not completely covered by original Medicare. By filling out these economic holes, Medigap prepares offer recipients monetary tranquility of mind by restricting their overall healthcare costs.

Moreover, Medigap plans can provide predictability in healthcare investing. With taken care of regular monthly premiums, recipients can budget better, understanding that their out-of-pocket expenses are much more controlled and regular. This predictability can be particularly beneficial for those on repaired revenues or tight budget plans.

Flexibility and Flexibility of Selection

Could flexibility and freedom of option in healthcare suppliers improve the general experience for Medicare recipients with Medigap policies? Absolutely. Among the key benefits of Medicare Supplement Insurance, or Medigap, is the adaptability it supplies in choosing doctor. Unlike some taken care of treatment strategies that limit individuals to a network of doctors and medical facilities, Medigap policies usually allow beneficiaries to see any doctor that accepts Medicare - Medicare Supplement plans near me. This freedom of selection encourages people to pick the physicians, professionals, and health centers that best fit their requirements and preferences.

Fundamentally, the versatility and freedom of option paid for by Medigap plans make it possible for recipients to take control of their medical care decisions and customize their treatment to satisfy their individual requirements and choices.

Rising Appeal Among Elders

The rise in appeal amongst elders for Medicare Supplement Insurance, or Medigap, emphasizes the expanding recognition of its benefits in enhancing healthcare insurance coverage. As seniors browse the intricacies of medical care alternatives, many are turning to Medicare Supplement plans to fill up the voids left by conventional Medicare. The assurance that includes knowing that out-of-pocket costs are lessened get redirected here is a considerable variable driving the enhanced passion in these policies.

Furthermore, the adjustable nature of Medicare Supplement prepares permits elders to customize their insurance coverage to suit their individual healthcare requirements. With a range of strategy choices readily available, elders can select the combination of benefits that best aligns with their healthcare requirements, making Medicare Supplement Insurance an attractive choice for numerous older adults wanting to secure extensive coverage.

Conclusion

Finally, Medicare Supplement Plans play an essential role in dealing with coverage voids and conserving costs for elders. Medigap plans supply versatility and freedom of choice for people looking for extra insurance protection - Medicare Supplement plans near me. Therefore, Medigap plans have seen a rise in appeal amongst seniors who value the advantages and peace of mind that come with having comprehensive insurance policy coverage

Report this page